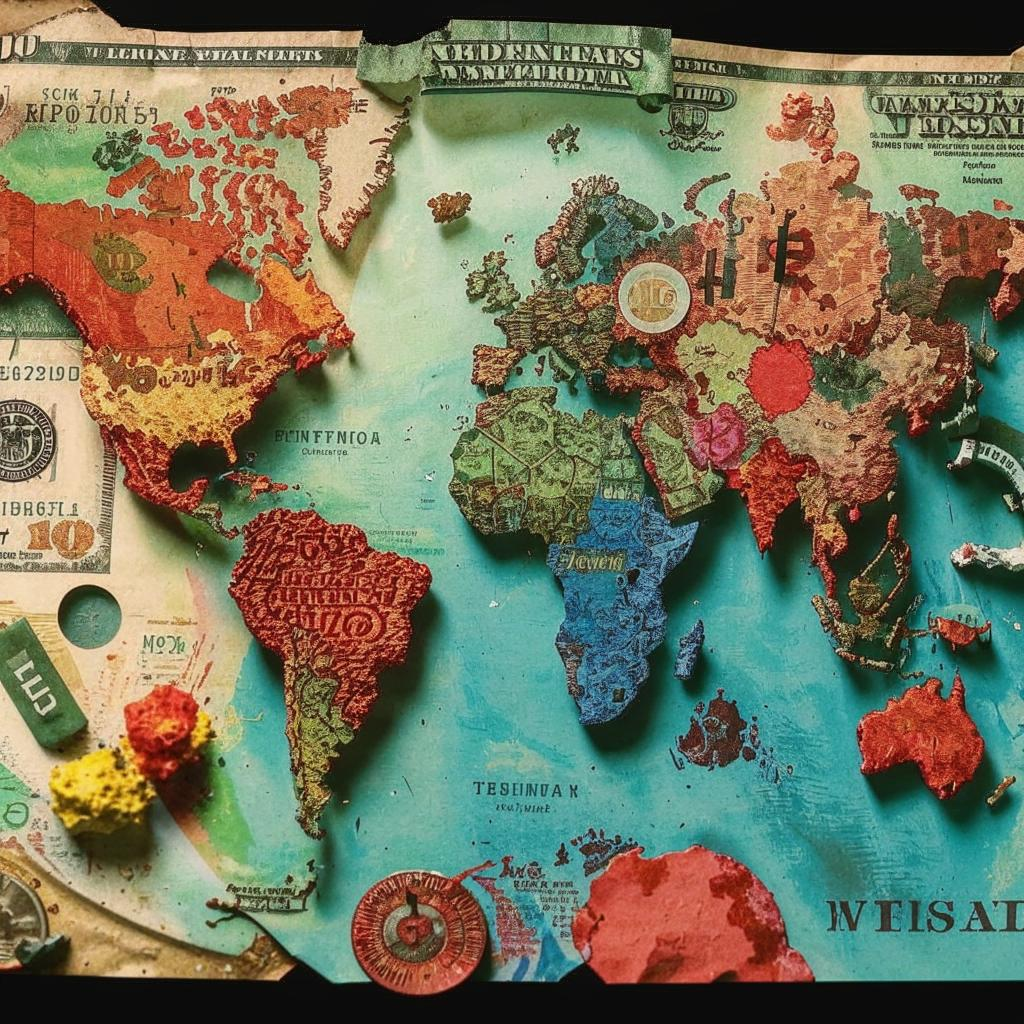

Emerging economies are increasingly exploring alternatives to the U.S. dollar in international trade and finance, fueled by geopolitical tensions and a desire for greater economic autonomy. The trend, often referred to as “de-dollarization,” involves countries reducing their reliance on the dollar for trade settlements, reserve holdings, and debt issuance. This shift is driven by concerns over U.S. foreign policy, sanctions, and the potential weaponization of the dollar-based financial system.

Several factors contribute to de-dollarization. Firstly, some nations seek to reduce their vulnerability to U.S. economic policies and sanctions. Secondly, there’s a growing recognition of the need for a more multi-polar global financial system that reflects the increasing economic weight of emerging markets. Finally, the rise of digital currencies and alternative payment systems offers new avenues for conducting cross-border transactions without relying on the dollar.

While a complete replacement of the dollar is unlikely in the near future, the trend toward de-dollarization is gaining momentum. This could lead to a more fragmented global financial landscape, with increased use of local currencies, regional trade agreements, and alternative reserve assets. The long-term implications of de-dollarization are still uncertain, but it undoubtedly represents a significant shift in the global balance of power.