Home Equity Lines of Credit (HELOCs) offer flexible borrowing, but rising interest rates dramatically impact payments. HELOCs typically have variable interest rates tied to a benchmark, like the prime rate. As the Federal Reserve raises rates to combat inflation, HELOC rates follow, increasing borrowing costs for homeowners.

The initial draw period allows borrowers to access funds, making minimum payments covering interest. After this, the repayment period begins, requiring principal and interest payments. Rate hikes during either phase significantly increase monthly obligations.

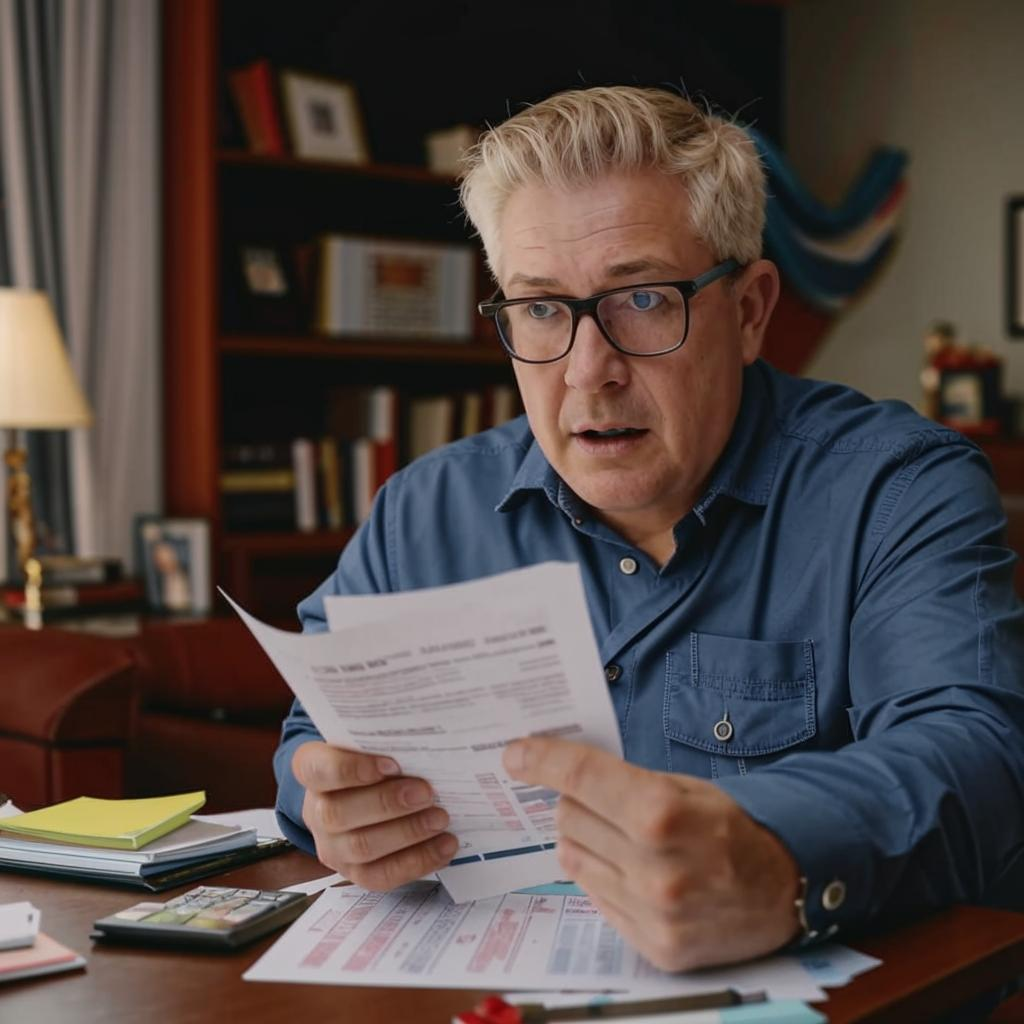

For example, a $50,000 HELOC with a 6% interest rate requires a monthly payment of $300 (interest-only). If the rate jumps to 8%, the payment climbs to $400. On the repayment period the increases can be substancial.

Homeowners can mitigate risk by considering fixed-rate HELOC options or paying down the balance aggressively during low-rate periods. Refinancing the HELOC into a fixed-rate home equity loan provides payment stability. Consulting a financial advisor helps tailor strategies to individual circumstances. Understanding the mechanics of HELOCs and proactive management empowers homeowners to navigate fluctuating interest rates effectively, protecting their finances. Keep on eye on the market, it may impact your HELOC payments.